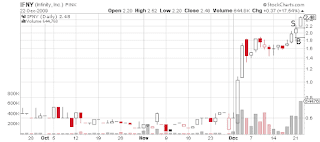

In this case the direction of Tim's trade is unambiguous from the chart. I am less sure about when the trade was entered. The sell price given in Tim's log is $3.35; on Dec 31, the stock traded between $3.32 (open and high) and $3.27 (close and low). Most likely selling short for $3.35 was impossible on Dec.31. It was also impossible on Dec. 30, but could be possible on Dec. 29 -- in that case, a break-down from the tight range of the previous 8 days (with a higher volume) must have been the signal.