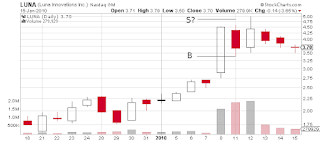

So I gather this stock was shorted because it was being pumped openly -- by the way this was done, as it happens, with explicit disclaimers: alas, attention spans get shorter and shorter, people do not read the disclaimers. As far as the chart goes, yes there was some selling pressure on Jan 7 but the stock ended the day about where it has began -- it's a doji candle. If one could short these stocks just because somebody paid to promote them, life would have been way too easy. According to his log, Tim sold at $1.41 and had to buy at $1.50.