I must admit I was wrong downplaying the importance of yesterday's gap in SNVP on the basis of intra-day dynamics. (A caveat -- these posts are written from a purely technical standpoint; it's irrelevant whether SNVP is a pump-and-dump, whether this is an oil and gas or cosmetics company, etc.) The stock continued to move higher with the same pattern: a ton of buying in the first 5 minutes of trading, seen in the 5 min chart where the excessive volume within the first 5 min bin is highlighted in red. This looks as if whoever is buying the stock is absent during the business hours and responds to some news received in between the trading sessions. What could explain such a buying pattern? Perhaps the stock is being promoted to some unsophisticated investors is Asia who out of necessity (the time zone difference) find it difficult to participate in real time? If that is the case, the stock may have a long way to go.

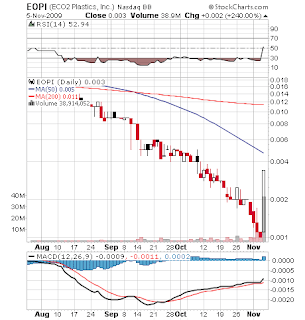

If I were to draw a conclusion on the basis of the very limited amount of observations in penny stocks (all of them documented here) I would conclude that one needs to put more weight on the inter-day dynamics (such as gaps between the days) and downplay what happens intra-day.

It seems too risky to short such a stock now, before there is evidence that the mania abates. Even if it abates,

a study I recently came across mentions that stocks touted via e-mail spam often fail to return to previous levels due to liquidity being too low to move the price either way once the stimulated interest wanes.